Can I Buy a Home Without My Spouse?

If you are preparing to purchase a home, you may be wondering how much your spouse has to be involved in the process, if at all. Many married couples purchase a home as co-borrowers, meaning both their names are on the mortgage and the title.

However, you may not want to include your spouse on the mortgage and may be wondering what your options are in the event that your spouse does not want to be on the mortgage or the title of your home.

Why You Would Not Include Your Spouse On the Mortgage

There are a number of reasons you may not want to include your spouse on your home’s mortgage. The main ones are typically due to a low credit score or lack of income.

Your Spouse Has a Low Credit Score

If your spouse has a low credit score or has defaulted on loans in the past, this could harm your ability to qualify for the home loan amount you want if your spouse is a co-borrower. When mortgage lenders pull the credit score for the borrower and co-borrower, they don’t simply use the highest credit score. Both credit scores must meet the qualifying standards, so it is really the lowest credit score that is the determining factor.

In the event that your spouse’s credit score could potentially damage your ability to qualify for lower interest rates, it might be best to leave your spouse off of the mortgage and only have one spouse as the borrower. If you absolutely need your spouse’s income to qualify for a decent loan amount, then take steps to work on improving your spouse’s credit score before getting pre-approved for a home loan.

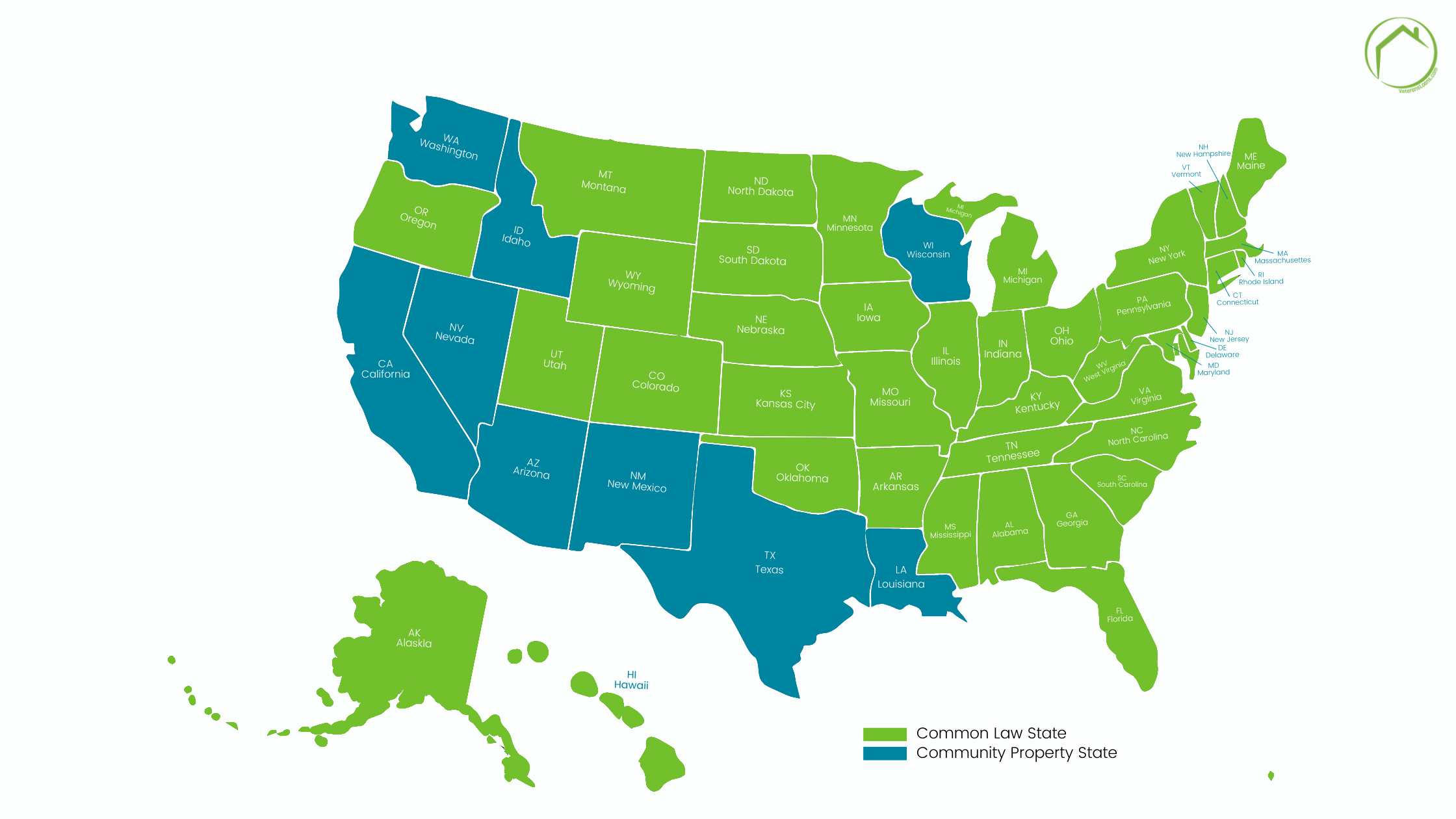

Community Property States vs. the Common-Law States

Community property states operate differently from common-law states. In community property states, your spouse’s credit history will be reviewed by the mortgage lender and factored into your loan approval, even if your spouse is not a co-borrower on the mortgage.

There are nine community property states in the United States:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

When qualifying for a loan in any of these states, a mortgage lender will examine the credit history of both spouses, even if only one spouse is technically a borrower on the mortgage. If you live in a community property state, both spouses are included on the title to a home, even if only one spouse is on the mortgage loan.

There is much more flexibility in “common-law states” in terms of property ownership.

Your Spouse’s Income Does Not Meet the Requirements

As a general rule, mortgage lenders require two of each item when approving borrowers for a home loan–two years of W-2s, two years of tax returns, and two months of bank statements. More documentation might be required depending on your employment situation. This all depends on the type of loan you are trying to qualify for, but in general, it is best practice to have all of this documentation prepared.

If one spouse cannot meet these income requirements for whatever reason, it is probably best to leave this spouse off of the mortgage. If one spouse is a stay-at-home parent and does not have any income history within the last two years, they will not be able to meet the qualifications for a home loan and should be left off of the mortgage.

You Can Still Include Your Spouse In the Title

You can include your spouse on the title of your home even if your spouse is not on the mortgage. This means that your spouse will be a co-owner of your home even if they are not responsible for the mortgage. If you live in a community property state, your spouse will be added to the title regardless.

Why You Would Include Your Spouse On the Mortgage

While it may seem easier to only have to provide information and documentation for one spouse, there are advantages to including your spouse on your home’s mortgage. Here are a few of them to consider.

You Can Qualify for a Larger Loan Amount

If you have a two-income household, qualifying for a mortgage loan together means qualifying for a larger home loan amount and better interest rates (if they have a good credit score). If your spouse is not a co-borrower, their income and finances will not be factored into your home loan application.

The one exception to this is USDA loans, which will factor in the household income regardless of whether one or both spouses are technically borrowers.

You Can Qualify for Better Mortgage Rates

If your spouse is a co-borrower with a good credit score and low debt-to-income ratio, this can help you achieve a lower mortgage rate. Adding your spouse’s income and credit history to the mortgage application could also potentially lower your collective debt-to-income (DTI) ratio. Obviously, this depends on how much debt you both have compared to your collective income.

Contact a Loan Specialist

Ready to get pre-approved? The loan specialists at VeteransLoans.com can determine your eligibility and get you pre-approved in a matter of minutes! VeteransLoans.com offers conventional, FHA, and VA products. Call 1 (888) 232-1428 to speak with a loan specialist today!