4 Reasons to Choose a Smaller Mortgage Lender

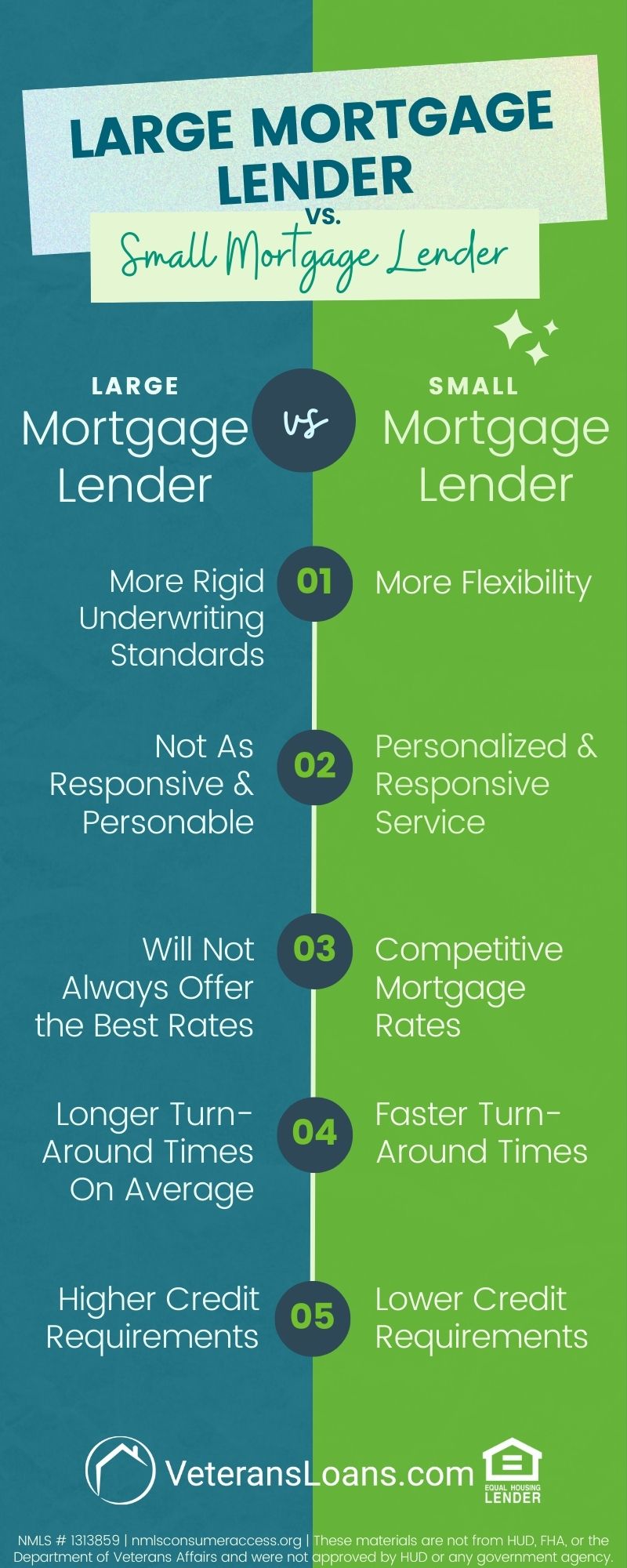

Large vs. Smaller Mortgage Lenders

There are many compelling reasons to choose a large established mortgage lender. Nationally renowned lenders come backed with big brand equity and big trust. It’s easy to know what you are getting into with a big name that has an established history and brand in the industry.

But have you ever considered the advantages of choosing a smaller mortgage lender, maybe even a local one? This article delves into a few of the main reasons why choosing a smaller mortgage lender might be the best option for you and what you can expect when you opt for the little guy.

Before you choose a mortgage lender, it’s important to keep these two pieces of advice in your mind:

- There is no right or wrong when it comes to choosing your mortgage lender. There is only the lender that is right for you. And the right mortgage lender for you all depends on your personal goals, finances, and expectations for your mortgage loan application experience.

- Shop different lenders. Do not settle for the first lender you contact, even if you ultimately decide to go with the first lender you contact, there are always advantages to shopping for different lenders before settling. Shopping with different lenders gives you a birds-eye view of what mortgage rates, products, and various benefits each lender has to offer and may even give you more negotiating power as the borrower.

While you’re shopping for a mortgage lender, here are a few reasons why you should consider going with the smaller lender:

4 Reasons to Choose a Smaller Mortgage Lender

More Flexibility

Larger mortgage lenders are likely to have rigid standards and few exceptions available compared with smaller lenders. The largest mortgage lenders handle a massive volume of mortgage loan applications and maximizing efficiency is the utmost priority. They can’t afford to spend time trying to figure out how to get someone in a unique financial situation approved for a mortgage loan.

Smaller mortgage lenders, however, have the flexibility to work with borrowers who don’t fit the cookie-cutter qualifications determined by the big guys. If you are unable to get pre-approved for a mortgage loan with one of the large mortgage lenders, don’t write yourself off before you have tried a smaller mortgage lender! They have the ability to offer lower credit requirements and more underwriting exceptions while still ensuring their borrowers can afford their mortgages.

Personalized and Responsive Service

Once again, efficiency is the name of the game with large mortgage lenders. Small mortgage lenders have the ability to maintain closer and more frequent contact with you, making your experience more personalized.

Smaller mortgage lenders also tend to be more readily responsive in their service, providing customer service that feels like family.

At VeteransLoans.com, we take pride in our customer service and the communicativeness and care we show our borrowers!

Competitive Mortgage Rates

With more flexibility comes more room to negotiate. Smaller mortgage lenders can often provide lower more competitive mortgage rates than the larger lenders. For a smaller mortgage lender, every potential borrower is valuable. If they can beat another competing rate, they will!

Faster Turn-Around Times

Large mortgage lenders tend to average 40-50 days to closing while the smaller mortgage lenders’ average turnaround times will typically be closer to 30-40 days. Since smaller mortgage lenders have the ability to be more responsive and keep in closer contact, that means that mortgage loan applications tend to move down the pipeline faster, expediting the underwriting process.

VeteransLoans.com has closed mortgage loan applications for home purchases in as short as 12 days! While we cannot guarantee a turnaround time of fewer than 30 days, it is absolutely possible and we dedicate ourselves to closing our borrowers’ loans in as timely a manner as possible.

Looking for a Mortgage Lender?

Are you in the market for a mortgage lender? Looking to get pre-approved? VeteransLoans.com is an established VA-approved lender that specializes in VA loans. We also offer FHA and conventional loan products and refinances for various products. Call 1 (888) 232-1428 to speak with a loan specialist today and start the pre-approval process!