Understanding VA Loans: A Deep Dive into VA Loan Minimum Property Requirements

Understanding VA Loans: A Deep Dive into VA Loan Minimum Property Requirements

When it comes to securing a home mortgage, VA loans stand out as an exceptional benefit for veterans, active-duty service members, and eligible surviving spouses. Offered through VeteransLoans.com, these loans come with unique advantages like no down payment and competitive rates. However, to qualify for a VA home loan, the property you’re eyeing must meet the VA loan minimum property requirements—also known as VA property requirements. These standards ensure the home is safe, sanitary, and structurally sound. Let’s explore what these requirements mean for your homebuying or refinancing journey.

Why VA Property Requirements Matter for Your Mortgage

The Department of Veterans Affairs (VA) sets these guidelines to protect borrowers and ensure the home’s value supports the loan. Whether you’re purchasing your first home or refinancing an existing VA loan, understanding these VA property requirements is crucial. At VeteransLoans.com, we guide you through the process, ensuring your dream home aligns with VA standards and your mortgage goals.

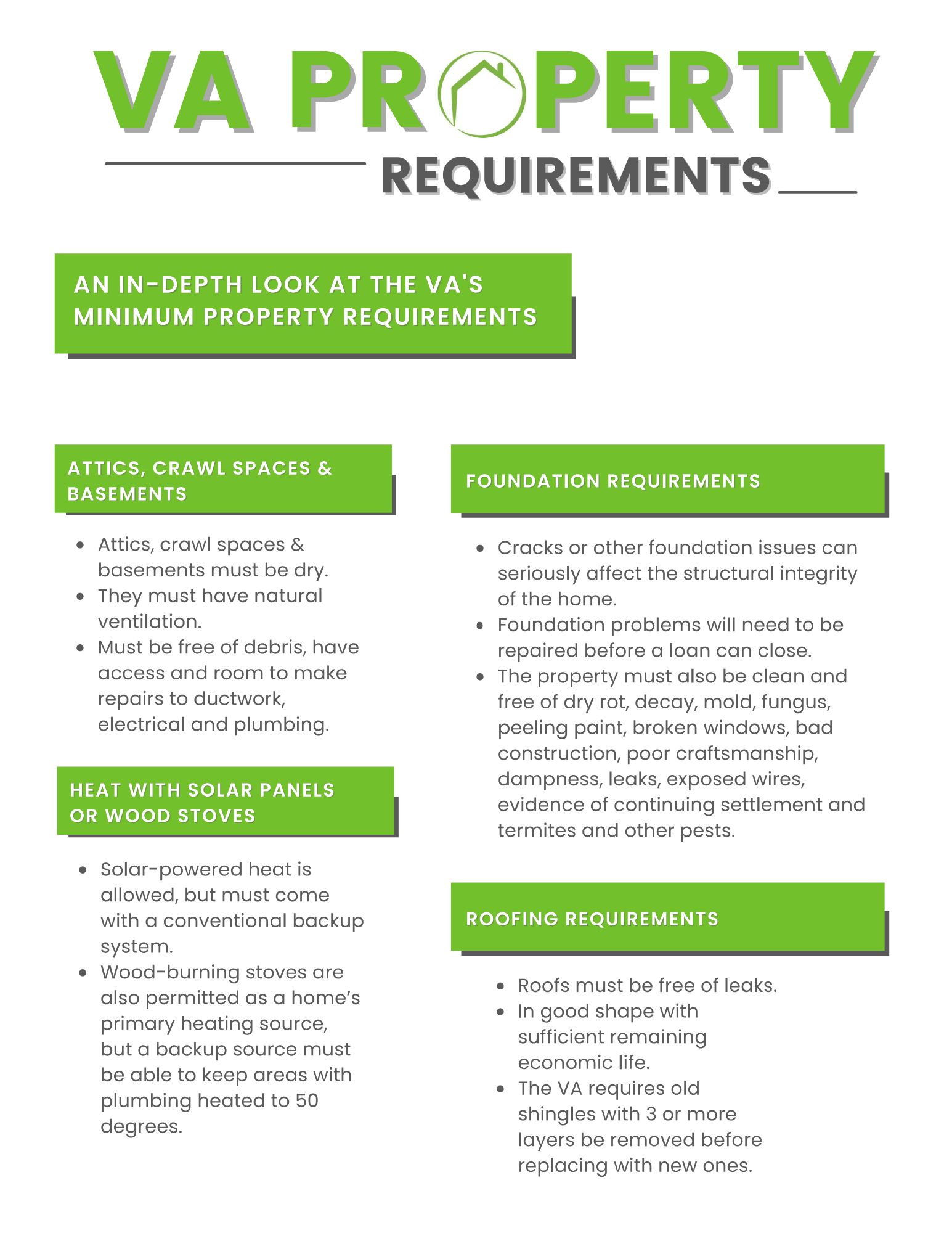

Attics, Crawl Spaces, and Basements: The Basics

A home’s hidden spaces—attics, crawl spaces, and basements—must pass muster for a VA loan. These areas need to be dry, naturally ventilated, and free of debris. They must also offer enough access and room for repairs to ductwork, electrical systems, and plumbing. Why? Because these conditions safeguard your investment and the home’s livability. If you’re eyeing a fixer-upper for a VA loan refinance, addressing dampness or clutter in these spaces is a must before closing.

Heating Systems: Solar Panels, Wood Stoves, and Backup Plans

VA loans are flexible about heating sources, but there are rules. Solar-powered heat is allowed, provided it’s paired with a conventional backup system to ensure reliability. Wood-burning stoves can serve as the primary heat source, but a backup must maintain 50-degree temperatures in areas with plumbing to prevent pipe damage. This requirement ensures your home remains functional year-round, a key factor when lenders assess VA property requirements for your mortgage approval.

Foundation Requirements: Structural Integrity is Key

The foundation is the backbone of any home, and the VA takes it seriously. Cracks or other issues must be repaired before your VA loan can close, as they threaten structural integrity. The property must also be free of dry rot, mold, peeling paint, broken windows, poor craftsmanship, leaks, exposed wires, settlement issues, and pests like termites. These standards protect your investment and ensure the home appraises well—a critical step in securing your VA home loan.

Roofing Requirements: Keeping You Covered

A solid roof is non-negotiable for VA loan minimum property requirements. It must be leak-free and have sufficient remaining economic life. If the roof has three or more layers of old shingles, they’ll need to be stripped before new ones are added. This ensures long-term durability, which is vital whether you’re buying a home or refinancing with a VA loan. A failing roof could delay your mortgage process, so plan for repairs if needed.

Location, Sites, and Drainage: Where Your Home Sits

Location matters for VA loans. The property can’t sit within the easement of high-voltage transmitters or gas/petroleum pipelines. If it’s within 220 yards of a pipeline, extra approval is required. Proper drainage away from the structure is also mandatory to prevent water damage. These VA property requirements ensure your home’s site supports its value and your mortgage security—key considerations for VeteransLoans.com when processing your loan.

Unique and Income-Producing Properties: A Challenge for VA Loans

Dreaming of a geodesic dome, converted church, or working ranch? These unique properties can complicate VA financing. Lenders, including us at VeteransLoans.com, often hesitate if there’s no recent comparable sale to justify the appraisal. Similarly, if a property’s highest and best use is commercial rather than residential, it may not qualify for a VA loan. For homebuyers or refinancers, sticking to traditional residential properties simplifies meeting VA loan minimum property requirements.

Water Requirements: A Necessity for Living

Every VA-financed home must have a continuous supply of potable water and domestic hot water. Springs or cisterns are acceptable if standard water delivery isn’t feasible, while shared wells are allowed with a recorded maintenance agreement ensuring adequate supply. These standards guarantee your home is livable—a non-negotiable for VA loan approval, whether you’re purchasing or refinancing.

How These Requirements Impact Your VA Loan Process

Meeting VA property requirements isn’t just about passing an inspection—it’s about ensuring your mortgage investment is sound. During the VA appraisal, an inspector checks these boxes, and any deficiencies must be addressed before closing. For buyers, this might mean negotiating repairs with the seller. For refinancers, it could involve fixing issues like a leaky roof or faulty foundation to qualify for a cash-out or streamline refinance. At VeteransLoans.com, we streamline this process, offering expert guidance tailored to VA loans.

Tips for Navigating VA Property Standards

- Work with a VA-Approved Lender: As a VA-approved lender, VeteransLoans.com knows the ins and outs of VA loan minimum property requirements.

- Inspect Early: Schedule a pre-appraisal check to spot issues like foundation cracks or poor drainage.

- Budget for Repairs: Whether buying or refinancing, set aside funds to meet VA standards if needed.

- Ask Questions: Unsure if a unique property qualifies? Contact us at 888-232-1428 for clarity.

At VeteransLoans.com we’re committed to helping veterans and eligible borrowers secure their dream homes or refinance with ease. Call us or visit www.veteransloans.com to ensure your home meets VA loan minimum property requirements and secures your mortgage future!