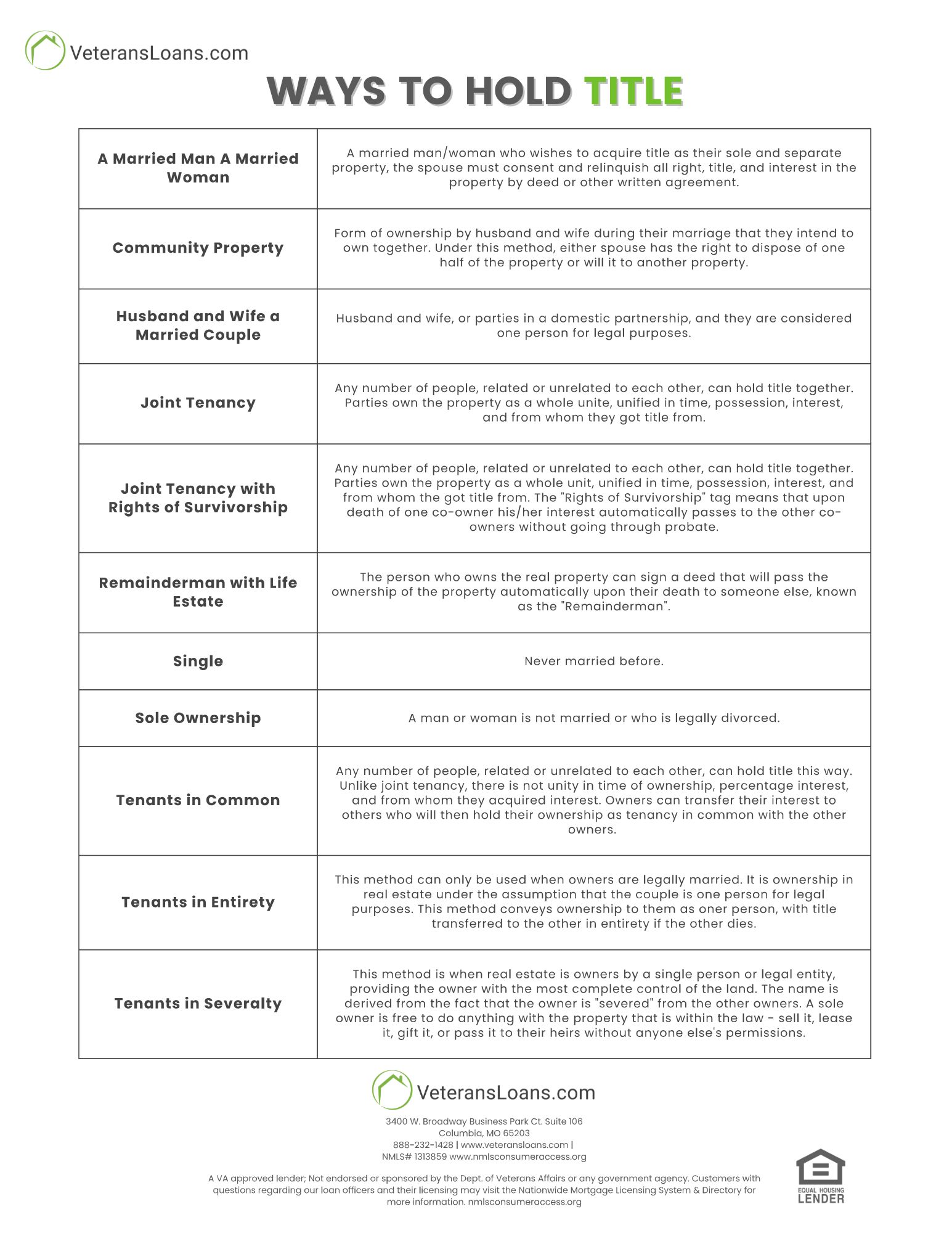

Ways to Hold Title in Real Estate: A Guide for Homebuyers and Refinancers

When buying a home or refinancing your mortgage, deciding how to hold title is a key step that affects ownership, inheritance, and your loan process. At VeteransLoans.com, we’re here to help you understand these options—whether you’re securing a home purchase loan or refinancing. Below, we break down the most common ways to hold title in real estate and ways to hold title when buying a house, with a mortgage-focused lens.

Sole Ownership: Full Control for Single Buyers

If you’re purchasing a home alone—perhaps as a never-married individual or someone legally divorced—sole ownership (tenants in severalty) offers total control. You can sell, lease, or bequeath the property without input from others. For mortgages, this simplifies approval since only your finances are reviewed.

Married Couples: Community Property and Tenancy Options

Married buyers or refinancers often choose community property or tenants in entirety. Community property lets spouses co-own the home, with each able to will half to someone else. This can impact refinancing if credit profiles differ. Tenants in entirety treat the couple as one entity, ensuring title transfers fully to the surviving spouse without probate—a perk for mortgage continuity.

Joint Tenancy: Flexibility for Co-Buyers

Buying with a partner or relative? Joint tenancy or joint tenancy with rights of survivorship allows co-owners to hold the property as a unit. Survivorship means a deceased owner’s share passes automatically to others, avoiding probate delays during a refinance or sale. Lenders assess all owners’ credit, so alignment is key.

Tenants in Common: Customizable Ownership

Tenants in common works for buyers wanting unequal shares—like friends or siblings investing together. There’s no survivorship, so shares can go to heirs, which may complicate mortgage applications but suits flexible ownership plans.

Refinancing to Remove a Spouse After Divorce

Divorce often requires rethinking title and mortgage terms. If you originally held title as community property, tenants in entirety, or joint tenancy with your spouse, you might need to refinance to remove them from the title and loan. This process involves qualifying for a new mortgage in your name alone, based on your income and credit. The ex-spouse must sign a quitclaim deed to relinquish their interest, ensuring you hold title as sole owner. At VeteransLoans.com, we’ve helped many navigate this transition—whether it’s post-divorce or after a domestic partnership ends—securing a fresh start with a tailored refinance.

Life Estates and Remainder Interests

For estate planning, a life estate with a remainderman lets you own the home now, with title passing to another upon your death. Refinancing may require the remainderman’s approval, affecting loan terms.

Why It Matters for Your Mortgage

How you hold title shapes your home loan approval, refinancing options, and future plans. Whether purchasing or refinancing, VeteransLoans.com ensures your mortgage aligns with your title choice.

Ready to explore your options? Contact us to see how these ways to hold title in real estate fit your homebuying or refinancing goals!