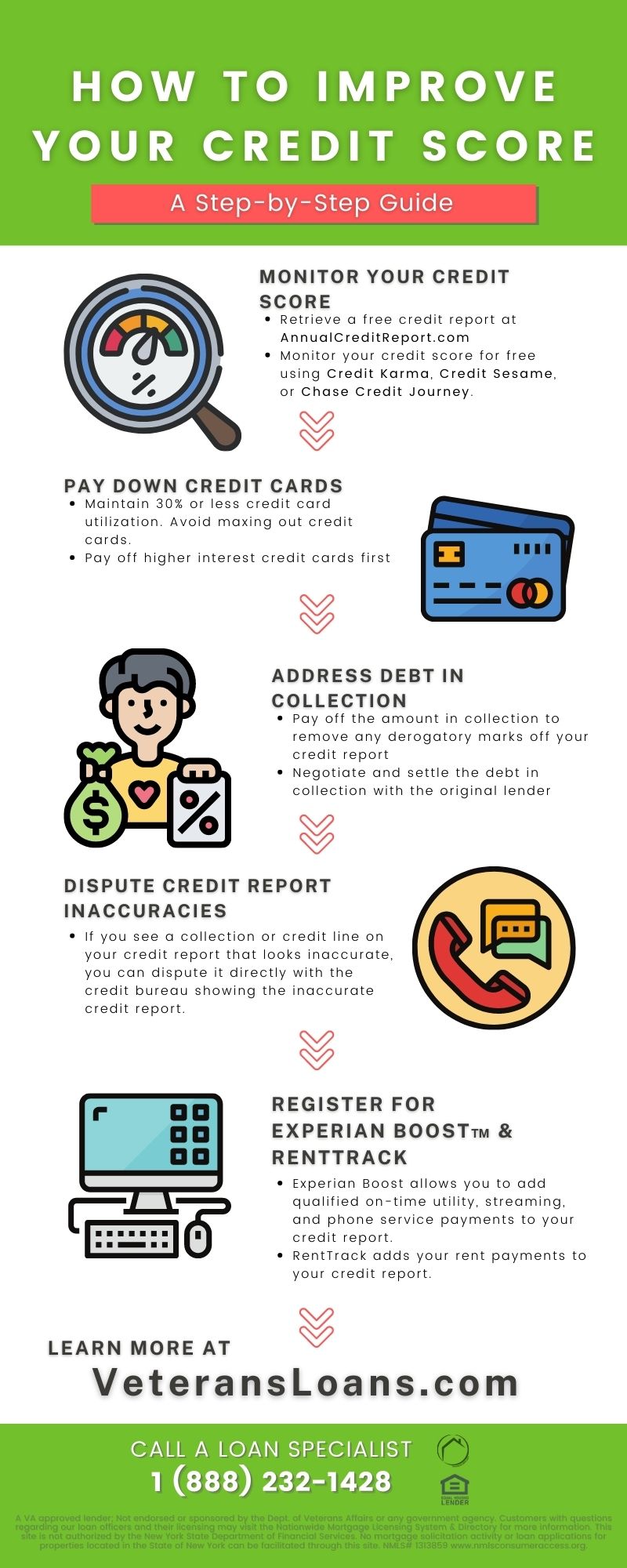

5 Ways to Improve Your Credit Score in 2022

It is never too late or too early to improve your credit score. Whether you have a poor credit score, a good credit score, or little to no credit history, you can only benefit from monitoring, maintaining, and taking steps to improve your credit score. And with the New Year just around the corner, what better time than now to begin working on your credit score?

Here are five ways you can effectively and quickly revamp your credit score:

Monitor Your Credit Score

If you do not already monitor your credit score, start tracking your credit score today. This will help you gain an understanding of how different credit accounts, balances, and payments affect your score. It will also help protect you against fraudulent activity and identity theft.

You can monitor your credit score for free on several websites, including Credit Karma, Credit Sesame, and Chase Credit Journey. You are also entitled to one free credit report each year from the three big credit bureaus Equifax, Experian, and TransUnion. You can retrieve this credit report through AnnualCreditReport.com.

Pay Down Credit Card Balances

The amount of revolving debt you carry with your total available credit plays a crucial role in determining your credit score. Make it a goal to maintain your credit card utilization below 30%. This will show creditors that you are responsible with credit.

If you have credit cards with high balances, it is best practice to begin paying off the high-interest credit cards first, since these will likely cost you the most in terms of interest than other loans like auto and federal student loans. If you are concerned about missing payments and accruing more interest and late fees, consider setting up automated payments for your credit card payments.

Address Debt in Collection

If you have a debt that has been sent to collection, you likely have accrued a derogatory mark on your credit score as a result. You can remove this derogatory mark on your credit score by negotiating with and paying off your debt with the collector.

You also have the option to pay off the debt in full or negotiate a settlement with the original lender and then ask them to reach out to the collection company to withdraw the derogatory mark from your credit report. It is in your best interest to address a debt that has gone to collection as soon as possible. Failure to do so could lead to ruined credit and even a lawsuit.

Dispute Credit Report Inaccuracies

If you see a collection or credit line on your credit report that looks inaccurate, like a payment that was reported as a late payment even if it was paid on time, you can file a dispute directly with the credit bureau showing the inaccurate credit report. Resolving inaccurate information on your credit report can give your credit score a boost. It can also protect you from potentially fraudulent activity and identity theft.

Register for Experian Boost™ and RentTrack

With Experian Boost™ you can add qualified on-time utility, streaming, and phone service payments to your credit report, which can ultimately help to boost your FICO® score. This is also a good way to cultivate your credit score if you are just beginning to build your credit history.

With RentTrack, you can add your rent payments to your credit report to boost your credit score. Keep in mind, this will only help your credit score if you make your payments and rent on-time. If you regularly miss payments or make your payments late, adding your utility and rent payments to your credit report will not help your score.

Contact a Loan Specialist

Interested in pre-qualifying for a home loan? Contact a loan specialist at VeteransLoans.com to get pre-qualified! Call 1 (888) 232-1428 today.