AM I ELIGIBLE FOR THE VA HOME LOAN?

The VA Home Loan | Home Loan 101 | 5 min

Summary:

In this article, we are going to go over the basic eligibility requirements for a VA Home Loan. The branch or department you served in, the length of your service, and the status of your discharge all determine your basic eligibility with the VA. Lenders also set credit score and income requirements, and we’ll talk about those, too.

The VA home loan is a unique home loan option with several attractive benefits, but not everyone is able to apply. You must meet the basic service requirements set by the Department of Veterans Affairs to qualify. Then, once you obtain your Certificate of Eligibility (more on that later), you’ll have to satisfy both our minimum credit score and debt-to-income ratio requirements. This may all sound complicated at first, but we’re here to show you that it doesn’t have to be. Let’s dive a little deeper.

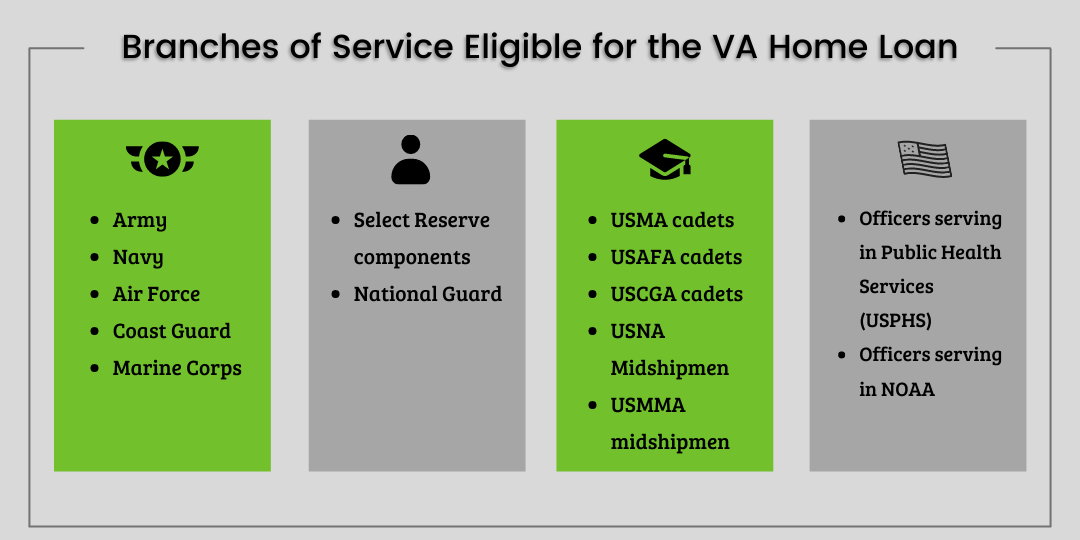

Eligible Branches of Service:

The first step in determining your eligibility is to make sure your service falls under one of the eligible branches. Service time in the active duty branches, National Guard, and reserve components are all eligible. Cadets in the Military Academy, Air Force Academy, Coast Guard Academy, and midshipmen in the Naval Academy are eligible too. Lastly, officers serving in the NOAA or Public Health Services are also eligible.

Service Requirements:

The required length of your service depends on when you served. For example, 90 consecutive days of active service during a period of wartime is typically enough to qualify, especially if you served after August 2, 1990. If your service was during peacetime, the service requirement is longer. Do you know you know your service date(s)? You can check the VA’s article on eligibility to see how long your service needs to be to qualify.

Certificate of Eligibility:

To prove you fulfill the basic service requirements set by the VA, you’ll need to obtain your Certificate of Eligibility (COE). Depending on your status and branch, you’ll need different documents ready when you apply for your COE. You can apply for your COE by clicking this link to the VA COE portal.

Documents required to obtain a COE:

- Veteran: a copy of your discharge or separation papers (DD214).

- Active-Duty Service Member: a statement of service—signed by your commander, adjutant, or personnel officer

- Current or Former Activated National Guard

or Reserve Member: a copy of your discharge or separation papers (DD214). - Current member of the National Guard or Reserves who has never been activated: a statement of service—signed by your commander, adjutant, or personnel officer

- Discharged member of the National Guard who was never activated: Your Report of Separation and Record of Service (NGB Form 22) for each period of National Guard service, and Your Retirement Points Statement (NGB Form 23) and proof of the character of service

- Discharged member of the Reserves who was never activated: A copy of your latest annual retirement points, and Proof of your honorable service

We know that paperwork can be a little much sometimes. But there’s good news- you don’t need to have it all figured out to get started. You can hop over to our application here, and we’ll help you sort it all out. Bye-bye paperwork.

Credit and Income:

Once you obtain your COE, you’ll need to make sure your credit and income qualify. The VA oversees the basic service requirements, but lets lenders set their own limits on credit and income. At VeteransLoans.com, we require a minimum credit score of 620 and a debt-to-income ratio (DTI) of less than 41%. We also have some residual income requirements that vary depending on family size and the location of the property. We’ll ask for verification of full-time employment as well. Self-employed folks should have proof of at least two years of consistent, sustained income.

Surviving Spouses:

Lastly, surviving spouses of a military member may also be eligible for the VA home loan. Additionally, surviving spouses granted the VA Home Loan benefit are exempt from paying the VA funding fee. Some examples of situations where you may be eligible include:

- An un-remarried surviving spouse of a military member who died while in service or from a service-oriented disability;

- Survivor of a service person missing in action (MIA) or a prisoner of war (POW) (limited to one-time use);

- Spouse of a Veteran who had been totally disabled and then died, but their disability may not have been the cause of death

Conclusion:

Ultimately, the best way to determine your eligibility is to give us a call at 1(888) 232-1428 so we can go over each step with you and help you out along the way. We’re dedicated to supporting Veterans and service members, and hearing about your specific situation can help us give you more tailored advice. We can help you get your COE, determine your credit score, and provide a more in-depth assessment of your DTI and income, too. If you don’t qualify at this time, then we’ll do our best to give you the knowledge you need to work towards qualification in the future.