VA Loan Limits and VA Entitlement for 2023

If you’re considering purchasing a home using a VA loan this year, you are probably wondering what the VA loan limits for 2023 are. Here is what you need to know about VA loan limits in 2023 and how this will affect your home purchase.

VA Loan Limits

The VA loan limits are determined by the Federal Housing Finance Agency. As of 2020, VA loan limits were eliminated for qualifying borrowers with full entitlement.

This means qualifying veterans, service members, and survivors with full entitlement are guaranteed up to 25% by the VA of virtually any loan amount. Other qualifying restrictions by lenders still apply when determining the amount you can borrow.

To determine your loan eligibility, lenders will use your credit history, income, and assets (savings, retirement, and investments) to determine the amount you can borrow.

VA Loan Limits Eliminated in 2020

Starting in 2020, VA loan limits were discontinued for qualifying veterans, service members, and survivors with full entitlement since the Department of Veterans Affairs is now able to guarantee loans that exceed the conforming loan limit. The Blue Water Navy Vietnam Veterans Act of 2019 was signed into law and eliminated the cap on VA loans. This law granted disability benefits to veterans exposed to Agent Orange in the Vietnam War. It also increased the VA funding fee.

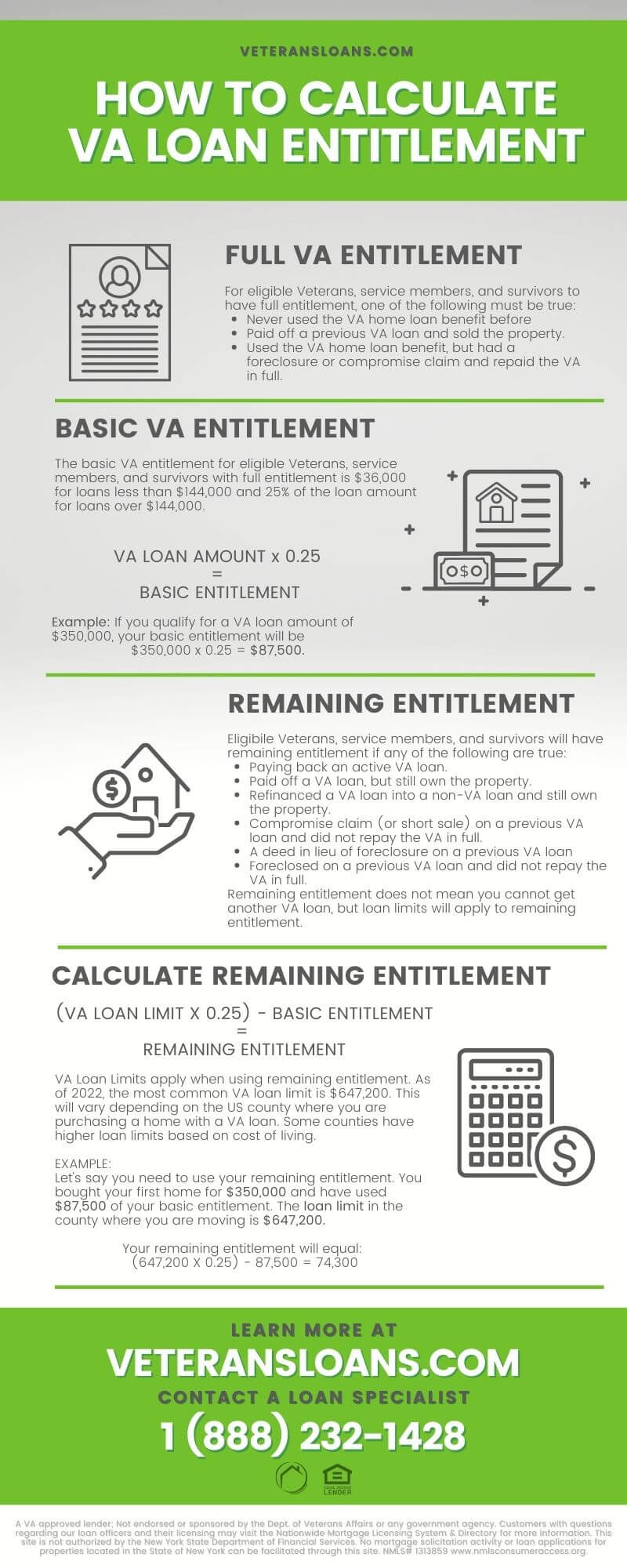

How to Calculate Remaining VA Loan Entitlement

Mortgage applicants who previously defaulted on a VA loan or already have active VA loans will still be subject to VA loan limits. While VA loan limits do not apply to qualified borrowers with full entitlement, they do come into play when a borrower has already used their entitlement.

Example

Let’s say you received a permanent change of orders and you need to buy a home at your new duty station. However, you are unable to sell your current home and restore your VA entitlement before you purchase your home in the location of your new duty station.

You will need to use your remaining VA entitlement. You previously used a VA loan to purchase your current home for $350,000 and you now need to purchase your second home for the standard limit of your new location, which is $647,200.

Step 1

To find our remaining entitlement, we first need to know how much of our VA entitlement or basic entitlement we have already used.

The amount of entitlement you have already used is equal to 25% of your VA-backed loan. Your original VA-backed loan was $350,000, so you have used $87,500 of your entitlement (350,000 X 0.25 = 87,500).

Step 2

Subtract your basic entitlement from 25% of the county VA loan limit of your new duty station to solve for your remaining entitlement. For the sake of this example, let’s say the conforming loan limit in your new duty station is the standard limit of $647,200.

It’s important to note that the loan limit could vary from county to county depending on the cost of living for that particular state and county. You can look up your county’s loan limit on the Federal Housing Finance Agency’s website.

25% of $647,200 = (647,200 X 0.25) = $161,800

Subtract $87,500 from $161,800 to find your remaining entitlement (161,800 – 87,500) = 74,300.

Your remaining VA entitlement is $74,300.

Your remaining entitlement is $74,300. Multiply this number by four to determine the total amount the VA will guarantee with no down payment (74,300 × 4 = 297,200). This brings the amount we can potentially borrow with no down payment using VA loan up to $297,200.

It’s important to note that just because the VA will only guaranty a loan up to the amount of $297,200, you can get a VA-backed loan larger than this amount if you make a down payment. VA-approved lenders typically want either the VA guaranty or your down payment, or both, to equal 25% of the VA-backed loan.

VA Loan Limits Do Not Limit How Much You Can Borrow

Anyone who is subject to a VA loan limit is still able to purchase a property over the county’s VA loan limit, as long as they can provide the required down payment and can actually afford to purchase the property. The required down payment is calculated using a formula based on your VA entitlement and the price of the home.

What is My VA Loan Limit in 2023?

Each county in the US is subject to a different VA loan limit. The easiest way to determine the loan limit in your area and whether the VA loan limit applies to you is to speak with a loan specialist from a VA-approved mortgage lender. Our loan specialists at VeteransLoans.com can walk you through all of your options, determine your eligibility, and get you pre-qualified in a matter of minutes. Call 1 (888) 232-1428 to speak with a loan specialist today!