What is the VA Appraisal?

Home Ownership | House hunting | 8 min

Summary:

In this article, we are going to go over the VA appraisal. We’ll talk about what things the appraisal process looks like, what it looks for, and what options you have if it doesn’t go as well as you would like.

The VA appraisal is an important step in the VA Home Loan process. Generally, your lender will order a VA appraisal once you’re under contract on a home. But what exactly is the VA appraisal, what does it look for, and what happens if it doesn’t go as well as you want?

What Does the Appraisal Process Look Like?

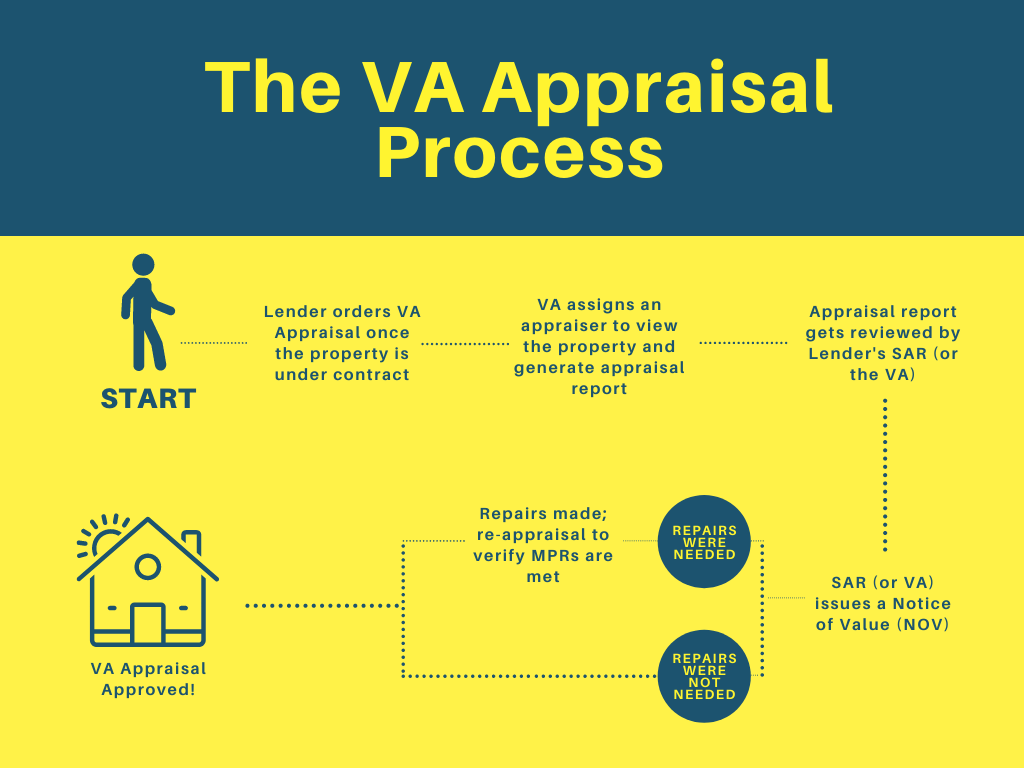

While any party can request a VA appraisal, your lender will typically order it once you’re under contract on a home. Once the appraisal is ordered, the VA will send a neutral, third party appraiser out to inspect the property. Neither the buyer nor the seller parties have influence on who will appraise the property.

Once complete, the appraiser’s report will be reviewed by your lender’s Staff Appraisal Reviewer (SAR) and a Notice of Value (NOV) will be issued. However, if your lender doesn’t have a SAR, the report will go to the VA for review.

This Notice of Value is the end result of a completed appraisal and takes into account several different factors when establishing a value for the home. In addition to the appraisal of the property itself, the NOV will also take into account comparable home sales in the same area. These “comps” compare the value of the property to recent sales of similar homes. Not having any comps – because your property is too unique, for example – can sometimes create issues. Lastly, the NOV will provide a list of any repairs needed to bring the property up to the VA’s Minimum Property Requirements.

What Does the Appraisal Look For?

The VA appraisal has two main goals: to establish a fair price for the property, and to make sure the property meets all of the VA’s Minimum Property Requirements (MPRs). The gist of the MPRs is that the VA wants to make sure that each property is safe, structurally sound, and sanitary. While not as thorough as a home inspection, the Appraisal will look at the condition of the house on a larger scale. Some of the MPRs include:

- Adequate Space: There must be adequate space for living, sleeping, cooking and dining, and sanitary facilities

- Water Supply: The property must have a continuous supply of safe and potable water for drinking, bathing, showering, and sanitary uses

- Sewage: There must be adequate, sanitary sewage disposal systems in place.

- Heating: Heating must be permanently installed and maintain a temperature of at least 50 degrees Fahrenheit in areas with plumbing.

- Roofing: The roof must “prevent entrance of moisture” and be in good condition.

- Attics, Crawl Spaces, and Basements: These spaces must be in good structural condition, without dampness or water damage, and have proper ventilation where applicable.

- Lead Based Paint: Chipped or flaking paint in house built prior to 1978 will have to be scraped and repainted, removed, or permanently covered.

- Wood destroying insects/fungus/dry rot: all damage to wooden structures from these sources will be noted and must be repaired. Termite inspection regionally required.

In addition to meeting the MPR’s, the NOV will include any other information important to the property’s eligibility. For example, condominiums must be in a VA-approved project.

What Happens if I don’t like the Results?

There are two different sets of challenges you might face following the appraisal, but don’t let either deter you. Let’s talk about some options you have if the appraisal doesn’t go perfectly. After the appraisal, you might find that:

1.) The appraised value is lower than the accepted offer.

The lender will not lend a penny over the appraised value. But even if the appraised value comes in low, you have some options.

- Pay the difference in cash: If you can afford it, you can make up the difference in cash. For example, if you’re under contract on a property for $185,000, and the appraised value is $180,000, you could make up the $5,000 in cash. Your lender will want supporting documentation to prove that you can afford this.

- Request a Reconsideration of Value: You can appeal the appraisal by asking for a Reconsideration of Value. This process allows you to submit supporting documentation in an attempt at raising the appraised value of the property.

- Negotiate with the seller: You can always ask the seller to match the VA Appraisal price.

- Walk: VA Home Loans come with a mandatory escape clause for situations just like this. Because of this, you should be able to walk away from the deal penalty free.

2.) The NOV lists required repairs to bring the property up to code with the VA MPRs.

Your NOV might come back with some mandatory repairs to be made before the property will meet approval. Often times these are small fixes, but sometimes not. If this happens to the property you’re hoping to snag, you can:

- Ask the seller to complete the repairs: You can always ask the sellers to complete the repairs. This is sometimes in their best interest, depending on the market. After all, they’ll need to have these repairs to be able to sell their home to you.

- Make the repairs yourself: You can talk to your loan officer about your lender’s policy on this, but it is possible to set money aside in a separate account to complete some types of repairs needed for a property to clear the MPRs.

- Walk: Again, you can take advantage of the escape clause here and walk away from the transaction.

This is not an exhaustive list, and we encourage you to talk to your loan officer about any questions you may have. Here at VeteransLoans.com, we value our ability to give each homeowner the care and attention needed to hit the small details every step of the way. We would love to answer any questions you might have about the VA Home Loan- all you need to do is give us a ring at 1-888-232-1428 or visit VeteransLoans.com.